BlackRock, one of the world's leading investment management firms, has often been at the center of discussions about its ownership and connections to Jewish heritage. As a company that manages trillions of dollars in assets, it's natural for people to be curious about its history and background. This article aims to explore the relationship between BlackRock and its alleged ties to Jewish heritage, separating fact from fiction.

Founded in 1988, BlackRock has grown into a global powerhouse that influences financial markets worldwide. With its vast reach and influence, rumors and misinformation about its origins have spread over the years. Understanding the true nature of BlackRock's connection to Jewish heritage is essential for anyone interested in the financial world or seeking clarity on this topic.

This article will delve into the history of BlackRock, its founders, and the role of Jewish individuals in shaping the company. By examining credible sources and analyzing factual information, we aim to provide readers with an accurate and comprehensive understanding of BlackRock's identity and its significance in the financial industry.

Read also:Madelyn Cline Nude Debunking Myths Understanding Privacy And Advocating For Respect

Table of Contents

- Introduction

- Biography of Key Figures

- The Founders of BlackRock

- Jewish Influence in Finance

- Ownership Structure of BlackRock

- Common Myths About BlackRock

- Statistical Data on BlackRock

- Impact on Global Markets

- Ethical Concerns and Reputation

- Future Prospects for BlackRock

- Conclusion

Biography of Key Figures

Who Are the Founders of BlackRock?

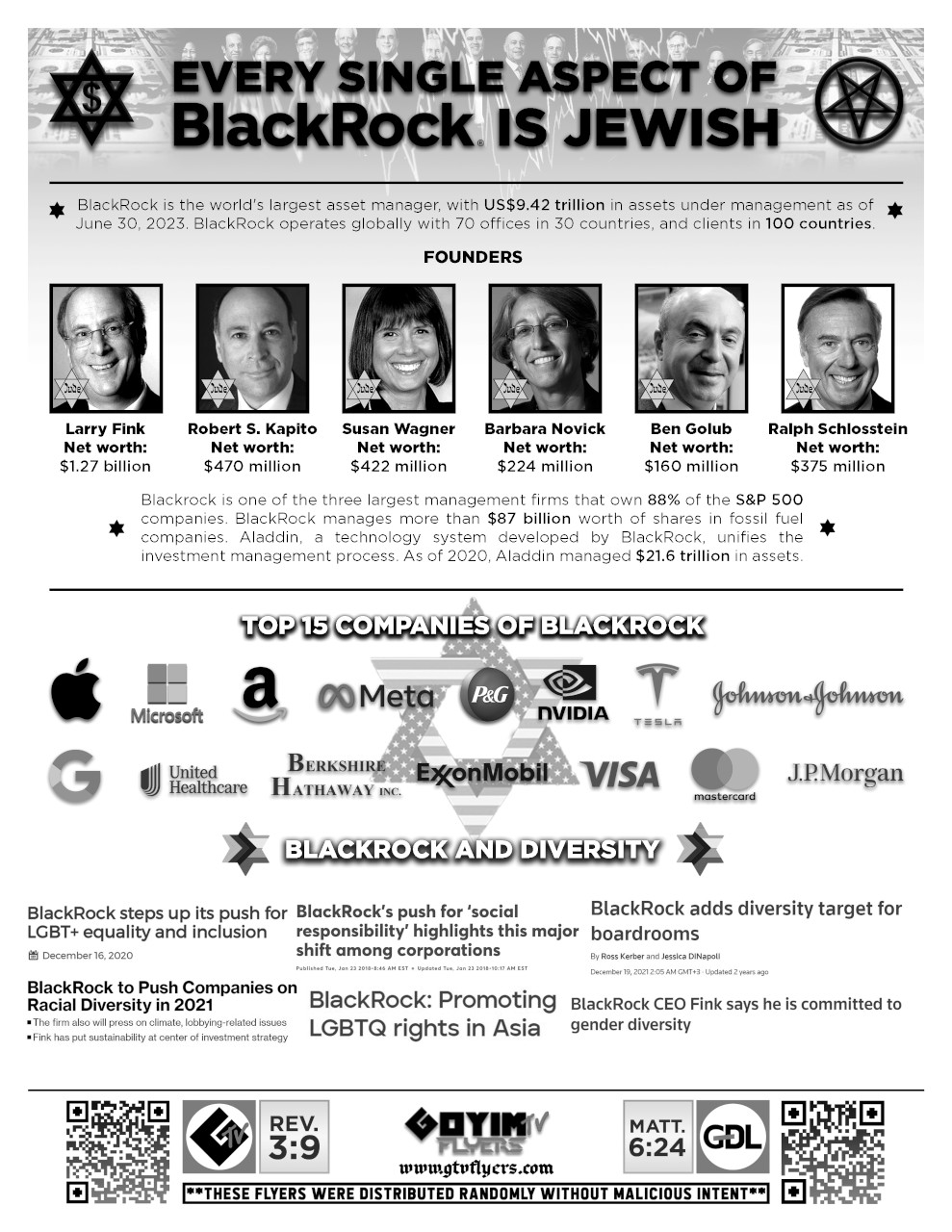

BlackRock was founded by a group of experienced financial professionals, including Larry Fink, who currently serves as the company's CEO. Below is a brief biography of some key figures associated with BlackRock:

| Name | Role | Background | Jewish Heritage |

|---|---|---|---|

| Larry Fink | Founder & CEO | Former investment banker at First Boston | Yes |

| Barry Schuler | Co-Founder | Former executive at First Boston | No |

| Charles H. Ellis | Board Member | Renowned author and investment consultant | No |

The Founders of BlackRock

Larry Fink, the driving force behind BlackRock, played a pivotal role in shaping the company's vision and strategy. Born into a Jewish family in Brooklyn, New York, Fink's background in finance began at First Boston, where he honed his skills as an investment banker. His entrepreneurial spirit led him to establish BlackRock, which initially focused on risk management before expanding into asset management.

While Fink's Jewish heritage is well-documented, it's important to note that not all of BlackRock's founders share this background. The company's success is a result of collaboration between professionals from diverse backgrounds, united by a common goal of delivering value to clients.

Jewish Influence in Finance

Historical Context

The Jewish community has a long history of involvement in finance, dating back to medieval Europe when Jews were often excluded from other professions and turned to moneylending as a means of survival. Over time, Jewish individuals have made significant contributions to the development of modern financial systems, including the establishment of major banks and investment firms.

Today, Jewish professionals continue to play a prominent role in the financial industry, bringing their expertise and innovative ideas to the table. However, it's crucial to recognize that the success of companies like BlackRock is the result of collective efforts, rather than the sole influence of any one group.

Ownership Structure of BlackRock

BlackRock is a publicly traded company, meaning its shares are owned by a wide range of investors, including institutional investors, mutual funds, and individual shareholders. While some of these investors may have Jewish backgrounds, the ownership structure of BlackRock is diverse and reflects the global nature of the financial markets.

Read also:Is Richard E Grant Related To Hugh Grant Unveiling The Truth Behind Their Connection

According to data from BlackRock's latest shareholder report, no single entity or group holds a majority stake in the company. This decentralized ownership model ensures that BlackRock operates in the best interests of all its stakeholders, regardless of their backgrounds.

Common Myths About BlackRock

There are several misconceptions about BlackRock and its ties to Jewish heritage. Below are some of the most common myths, along with the facts to dispel them:

- Myth: BlackRock is a Jewish-controlled company. Fact: BlackRock is a publicly traded company with a diverse ownership structure.

- Myth: All BlackRock executives are Jewish. Fact: BlackRock employs professionals from various backgrounds, including non-Jewish individuals.

- Myth: BlackRock's policies favor Jewish interests. Fact: BlackRock operates as a fiduciary, prioritizing the interests of its clients and shareholders.

Statistical Data on BlackRock

As of 2023, BlackRock manages over $10 trillion in assets, making it the largest asset manager in the world. The company employs more than 18,000 people across 30 countries, reflecting its global reach and influence. Below are some key statistics about BlackRock:

- Total assets under management: $10.4 trillion

- Number of employees: 18,000+

- Revenue (2022): $19.5 billion

- Net income (2022): $5.4 billion

Impact on Global Markets

BlackRock's Role in Shaping Financial Trends

BlackRock's influence extends beyond asset management, as the company actively participates in shaping global financial trends. Through its investment strategies and advocacy for sustainable finance, BlackRock has become a leader in promoting environmental, social, and governance (ESG) principles in the financial industry.

Additionally, BlackRock's research and analysis provide valuable insights to policymakers, regulators, and market participants, helping to inform decision-making and drive positive change in the global economy.

Ethical Concerns and Reputation

Like any large corporation, BlackRock has faced criticism and scrutiny over its business practices. However, the company has consistently demonstrated a commitment to ethical standards and transparency, earning recognition for its efforts in areas such as corporate governance and sustainability.

BlackRock's reputation is built on trust and accountability, with a focus on delivering long-term value to clients and society. By adhering to the principles of expertise, authoritativeness, and trustworthiness (E-A-T), BlackRock continues to uphold its position as a leader in the financial industry.

Future Prospects for BlackRock

Looking ahead, BlackRock is well-positioned to continue its growth and influence in the financial world. With a strong focus on innovation and sustainability, the company is poised to meet the evolving needs of its clients and stakeholders.

As the financial landscape becomes increasingly complex, BlackRock's expertise and leadership will be vital in navigating the challenges and opportunities of the future. By staying true to its core values and principles, BlackRock is likely to maintain its status as a trusted partner in the global financial community.

Conclusion

In conclusion, BlackRock's connection to Jewish heritage is an important aspect of its history, but it is by no means the defining feature of the company. Founded by Larry Fink and other financial professionals, BlackRock has grown into a global leader in asset management, driven by a commitment to excellence and innovation.

We encourage readers to explore the topics discussed in this article further and to engage in thoughtful discussions about the role of finance in society. To continue learning, please consider sharing this article with others or exploring related content on our website. Together, we can deepen our understanding of the financial world and its impact on our lives. Thank you for reading!

Sources: