Lincoln Heritage Final Expense Reviews has become a critical topic for those seeking life insurance options to cover end-of-life expenses. With the increasing demand for affordable and reliable final expense insurance, it's essential to evaluate the offerings of various providers. In this article, we will explore Lincoln Heritage's final expense insurance plans, their benefits, drawbacks, and customer reviews to help you make an informed decision.

Final expense insurance plays a crucial role in ensuring that your loved ones are not burdened with unexpected costs after you pass away. This type of insurance is specifically designed to cover expenses such as funeral arrangements, medical bills, and other end-of-life costs. Understanding the options available, including Lincoln Heritage's offerings, can help you select the best plan for your needs.

In this article, we will provide an in-depth analysis of Lincoln Heritage Final Expense Reviews, breaking down its features, pricing, and customer feedback. Whether you're new to final expense insurance or looking to switch providers, this guide will equip you with the knowledge to make a confident choice.

Read also:Madelyn Cline Nude Debunking Myths And Understanding Privacy In The Digital Age

Table of Contents

- Introduction to Lincoln Heritage Final Expense Insurance

- Key Benefits of Lincoln Heritage Final Expense Insurance

- Lincoln Heritage Final Expense Plans

- Pricing Structure and Coverage Options

- Eligibility Criteria

- Customer Reviews and Testimonials

- Lincoln Heritage vs. Competitors

- Claims Process and Support

- Frequently Asked Questions

- Conclusion and Call to Action

Introduction to Lincoln Heritage Final Expense Insurance

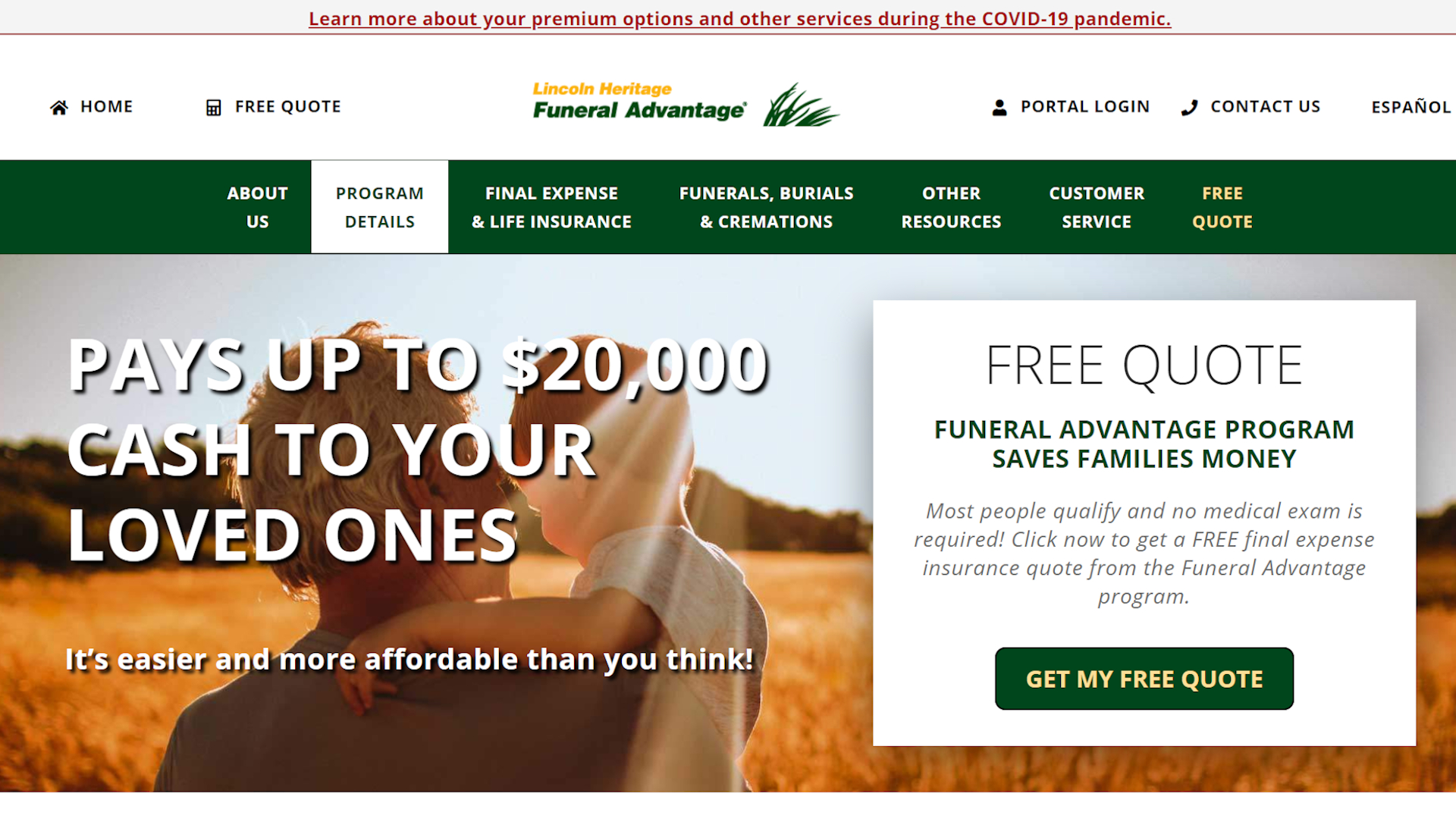

Lincoln Heritage Final Expense Insurance is a well-established provider specializing in life insurance products tailored to cover end-of-life expenses. Founded with a commitment to offering affordable and flexible plans, Lincoln Heritage has become a trusted name in the insurance industry. Their focus on customer satisfaction and comprehensive coverage makes them an attractive option for individuals seeking final expense insurance.

This section delves into the history of Lincoln Heritage and its mission to provide affordable insurance solutions. By understanding the company's background and values, you can gain insight into why they stand out in the market. Additionally, we will explore the core principles that guide their insurance offerings.

History and Background

Lincoln Heritage was established with the goal of addressing the growing need for affordable final expense insurance. Over the years, the company has expanded its reach and improved its services to cater to a diverse range of clients. Their dedication to providing high-quality insurance products has earned them a solid reputation in the industry.

Core Values

At the heart of Lincoln Heritage's operations are values such as transparency, reliability, and customer-centric service. These principles guide their approach to offering insurance plans that meet the unique needs of each client. By prioritizing these values, Lincoln Heritage ensures that their customers receive the support and coverage they deserve.

Key Benefits of Lincoln Heritage Final Expense Insurance

One of the standout features of Lincoln Heritage Final Expense Insurance is the array of benefits it offers. From flexible coverage options to straightforward application processes, this provider aims to make securing final expense insurance as seamless as possible.

Flexible Coverage Options

Lincoln Heritage offers a variety of coverage options to suit different budgets and needs. Whether you require basic coverage for funeral expenses or more extensive coverage for additional end-of-life costs, they have plans tailored to fit your requirements. This flexibility ensures that you can choose a plan that aligns with your financial situation and priorities.

Read also:Golisano Childrens Museum Of Naples A Funfilled Destination For Families

Simplified Application Process

Applying for Lincoln Heritage Final Expense Insurance is a straightforward process. The company has streamlined its application procedures to make it easier for clients to secure coverage quickly. With minimal paperwork and hassle-free steps, you can obtain the protection you need without unnecessary delays.

Lincoln Heritage Final Expense Plans

Lincoln Heritage offers several plans designed to cater to different customer needs. Understanding these plans is essential to selecting the one that best suits your circumstances. Below, we will explore the various options available and highlight their key features.

Basic Coverage Plan

- Designed for individuals seeking affordable coverage for essential end-of-life expenses.

- Covers basic funeral costs and related expenses.

- Ideal for those with a limited budget.

Premium Coverage Plan

- Offers extended coverage for additional end-of-life costs.

- Includes provisions for medical bills and other related expenses.

- Suitable for individuals seeking more comprehensive protection.

Pricing Structure and Coverage Options

When evaluating Lincoln Heritage Final Expense Insurance, it's important to consider the pricing structure and coverage options. The company offers competitive rates that reflect the level of coverage provided. Below, we will break down the pricing details and explain how they align with the benefits offered.

Competitive Pricing

Lincoln Heritage strives to provide affordable pricing without compromising on quality. Their rates are determined based on factors such as age, health, and coverage amount. By offering transparent pricing, they ensure that customers can make informed decisions about their insurance needs.

Eligibility Criteria

Understanding the eligibility criteria for Lincoln Heritage Final Expense Insurance is crucial to determining whether you qualify for coverage. The company has set specific guidelines to ensure that their plans are accessible to a wide range of individuals. Below, we will outline the key eligibility requirements.

Age Requirements

Lincoln Heritage offers coverage to individuals within a specific age range, ensuring that their plans are suitable for both younger and older applicants. By setting clear age parameters, they can provide tailored solutions that meet the needs of their diverse client base.

Customer Reviews and Testimonials

Customer reviews play a vital role in evaluating the quality of Lincoln Heritage Final Expense Insurance. By analyzing feedback from real customers, you can gain valuable insights into the strengths and weaknesses of their offerings. Below, we will summarize some of the most common reviews and testimonials.

Positive Feedback

- Many customers praise Lincoln Heritage for their excellent customer service and responsive support team.

- Others highlight the ease of the application process and the transparency of the pricing structure.

Constructive Criticism

- Some customers have noted that certain plans may not offer sufficient coverage for their needs.

- Others suggest that additional options could enhance the flexibility of the available plans.

Lincoln Heritage vs. Competitors

Comparing Lincoln Heritage Final Expense Insurance with other providers in the market can help you make an informed decision. Below, we will analyze how Lincoln Heritage stacks up against its competitors in terms of pricing, coverage, and customer service.

Pricing Comparison

Lincoln Heritage's competitive pricing places them favorably against many of their competitors. While other providers may offer similar coverage options, Lincoln Heritage's commitment to affordability ensures that their plans remain accessible to a broader audience.

Claims Process and Support

Understanding the claims process and the level of support offered by Lincoln Heritage is crucial to ensuring a smooth experience when filing a claim. Below, we will outline the key steps involved in the claims process and highlight the resources available to assist you.

Step-by-Step Claims Process

- Contact Lincoln Heritage's customer service team to initiate the claims process.

- Provide the necessary documentation and information to support your claim.

- Track the progress of your claim through their user-friendly online portal.

Frequently Asked Questions

Below are some of the most frequently asked questions about Lincoln Heritage Final Expense Insurance. These answers aim to address common concerns and provide clarity on key aspects of their offerings.

What is final expense insurance?

Final expense insurance is a type of life insurance designed to cover end-of-life expenses, such as funeral costs, medical bills, and other related costs. It ensures that your loved ones are not burdened with unexpected financial burdens after your passing.

How do I qualify for Lincoln Heritage Final Expense Insurance?

To qualify for Lincoln Heritage Final Expense Insurance, you must meet specific eligibility criteria, including age requirements and health conditions. The application process involves providing necessary documentation and undergoing a brief assessment.

Conclusion and Call to Action

In conclusion, Lincoln Heritage Final Expense Insurance offers a reliable and affordable solution for individuals seeking coverage for end-of-life expenses. With its flexible plans, competitive pricing, and excellent customer service, Lincoln Heritage stands out as a top choice in the insurance market. By carefully evaluating their offerings and considering customer reviews, you can make an informed decision about your insurance needs.

We invite you to share your thoughts and experiences with Lincoln Heritage Final Expense Insurance in the comments section below. Your feedback can help others make better-informed decisions. Additionally, don't forget to explore other articles on our site for more valuable insights into life insurance and financial planning.