Unemployment can be a challenging phase in anyone's life, but understanding the tax implications, such as the 1099-G unemployment form, can help ease the burden. If you've received unemployment benefits during the year, you'll likely receive a 1099-G form, which reports the amount of those benefits to the IRS. This guide will walk you through everything you need to know about 1099-G unemployment, ensuring you're well-prepared for tax season.

The 1099-G unemployment form plays a crucial role in your tax filing process. It details the payments you received from state or local governments, including unemployment compensation. Understanding this form is essential to avoid any surprises when it comes time to file your taxes. In this article, we'll delve into the specifics of the 1099-G form, its purpose, and how it affects your tax obligations.

Whether you're a first-time recipient of unemployment benefits or have experience with them, staying informed about the 1099-G form is vital. This document not only reports your unemployment compensation but also affects your overall tax liability. Let's explore how this form works, what you need to do with it, and how to ensure compliance with IRS regulations.

Read also:Walthers Model Trains A Comprehensive Guide To The Worlds Most Iconic Model Trains

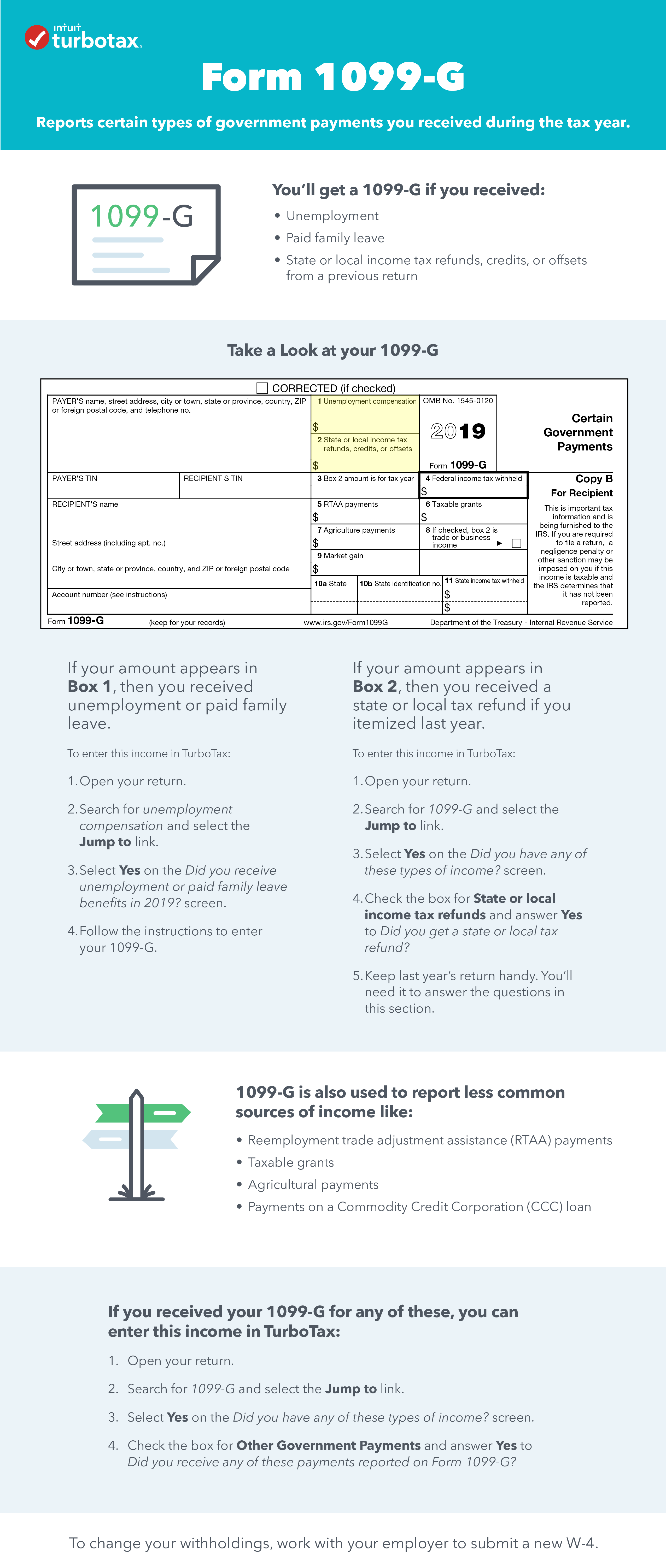

What is the 1099-G Form?

The 1099-G form is an informational tax document issued by state or local governments to report certain payments made to individuals during the tax year. For recipients of unemployment benefits, this form details the total amount of unemployment compensation received. It's essential for accurately reporting income on your federal tax return.

Key Features of the 1099-G Form

Here are some key aspects of the 1099-G form:

- Box 1: Total Payments – This box shows the total amount of unemployment benefits you received during the year.

- Box 3: Unemployment Compensation – Specifically reports unemployment benefits, which are taxable income.

- Box 4: Federal Income Tax Withheld – Indicates any federal taxes withheld from your unemployment payments.

These details are critical for calculating your taxable income and ensuring you pay the correct amount of taxes.

Who Receives the 1099-G Form?

Not everyone receives a 1099-G form. It's typically issued to individuals who have received payments from government entities, such as unemployment benefits, state tax refunds, or other government reimbursements. If you've received unemployment compensation during the year, you should expect to receive this form by the end of January.

Eligibility Criteria for 1099-G

Here’s who qualifies to receive a 1099-G:

- Individuals who received unemployment benefits.

- Taxpayers who received state or local tax refunds exceeding $600.

- Recipients of other government payments, such as disaster relief funds.

Understanding your eligibility ensures you're prepared for the tax filing process and aware of your responsibilities.

Read also:Air Peace Nigeria Revolutionizing Air Travel In West Africa

How Does the 1099-G Form Affect Your Taxes?

The 1099-G form directly impacts your tax return because it reports income that may be subject to federal taxation. Unemployment benefits, as indicated in Box 3, are considered taxable income. This means you must include the reported amount when calculating your total income for the year.

Tax Implications of Unemployment Benefits

Here’s how unemployment compensation affects your taxes:

- Unemployment benefits are fully taxable at the federal level.

- Some states also tax unemployment benefits, so check your state's tax laws.

- If federal income tax wasn't withheld from your benefits, you might owe additional taxes when filing your return.

Properly accounting for these payments ensures you meet your tax obligations and avoid penalties.

Steps to File Taxes with a 1099-G Form

Filing your taxes with a 1099-G form requires careful attention to detail. Follow these steps to ensure accuracy and compliance:

- Review your 1099-G form to confirm the reported amounts are correct.

- Report the unemployment compensation listed in Box 3 on your Form 1040 or Form 1040-SR.

- Include any federal income tax withheld in Box 4 to reduce your total tax liability.

- Double-check all entries for accuracy before submitting your tax return.

These steps help streamline the filing process and minimize the risk of errors.

Common Mistakes to Avoid with 1099-G Unemployment

Mistakes on your 1099-G form can lead to tax complications. Here are some common errors to avoid:

- Forgetting to report unemployment compensation as taxable income.

- Not accounting for federal taxes withheld from your benefits.

- Failing to verify the accuracy of the amounts reported on your 1099-G.

By staying vigilant and reviewing your forms carefully, you can avoid unnecessary tax issues.

Tips for Managing Unemployment Benefits and Taxes

Managing unemployment benefits and their tax implications requires planning. Here are some tips to help you stay organized:

- Opt for federal income tax withholding from your unemployment benefits to simplify tax payments.

- Track your income and expenses throughout the year to maintain accurate records.

- Consult a tax professional if you're unsure about how to handle unemployment benefits on your tax return.

Proactive management of your finances can ease the stress of tax season.

Understanding Tax Withholding Options

When receiving unemployment benefits, you have the option to have federal income tax withheld. This can help you avoid a large tax bill at the end of the year. To set up withholding, complete and submit Form W-4V to your state unemployment office.

Benefits of Voluntary Withholding

Here’s why opting for voluntary withholding might be beneficial:

- It ensures consistent tax payments, reducing the risk of underpayment penalties.

- It simplifies the tax filing process by automatically deducting taxes from your benefits.

- It helps you avoid unexpected tax liabilities when filing your return.

Consider this option if you prefer a more structured approach to managing your taxes.

State-Specific Considerations for 1099-G Unemployment

State tax laws can vary significantly when it comes to unemployment benefits. Some states exempt unemployment compensation from state taxes, while others treat it the same as federal taxes. Research your state's specific regulations to ensure compliance.

Examples of State Tax Treatment

Here’s how different states handle unemployment benefits:

- California: Exempts unemployment benefits from state taxation.

- New York: Taxes unemployment benefits similarly to federal rules.

- Texas: Does not have a state income tax, so unemployment benefits aren't taxed at the state level.

Knowing your state's policies helps you plan accordingly and avoid surprises during tax season.

How to Request a Corrected 1099-G Form

If you notice discrepancies on your 1099-G form, it's important to request a corrected version. Contact the issuing agency promptly to resolve any issues. Provide documentation supporting your claim, such as bank statements showing the correct payment amounts.

Steps to Request a Correction

Follow these steps to obtain a corrected 1099-G:

- Gather all relevant documentation to support your request.

- Contact the state unemployment office or issuing agency to report the error.

- Follow up regularly to ensure the correction is processed in a timely manner.

Addressing errors promptly ensures your tax return is accurate and compliant.

Conclusion: Mastering the 1099-G Unemployment Process

In summary, understanding the 1099-G unemployment form is essential for accurate tax reporting. By familiarizing yourself with its purpose, key features, and tax implications, you can navigate the tax filing process with confidence. Remember to:

- Review your 1099-G form carefully for accuracy.

- Report all unemployment compensation as taxable income.

- Consider voluntary withholding to simplify tax payments.

- Consult a tax professional if you need guidance.

We encourage you to share this article with others who might find it helpful and leave a comment below if you have questions or additional insights. For more information on taxes and financial planning, explore our other resources on the site.

Table of Contents

- What is the 1099-G Form?

- Who Receives the 1099-G Form?

- How Does the 1099-G Form Affect Your Taxes?

- Steps to File Taxes with a 1099-G Form

- Common Mistakes to Avoid with 1099-G Unemployment

- Tips for Managing Unemployment Benefits and Taxes

- Understanding Tax Withholding Options

- State-Specific Considerations for 1099-G Unemployment

- How to Request a Corrected 1099-G Form

- Conclusion: Mastering the 1099-G Unemployment Process