Filing your taxes can be a complex process, especially when it comes to understanding the intricacies of state tax refunds and Form 1099-G. Many taxpayers find themselves overwhelmed by the details of this form and its implications on their federal tax returns. This guide aims to demystify the concept of tax state refunds and how Form 1099-G plays a crucial role in the process. By the end of this article, you'll have a clearer understanding of how to handle your state tax refund effectively.

Whether you're a first-time filer or a seasoned taxpayer, knowing how to manage your state refund is essential for ensuring compliance with IRS regulations. Form 1099-G serves as a vital document that reports certain government payments, including state tax refunds, to the IRS. It's important to pay attention to this form to avoid potential errors in your tax filings.

Our goal is to provide you with actionable insights and expert advice to navigate the complexities of Form 1099-G and state tax refunds. This article will cover everything you need to know, from the basics to advanced tips, ensuring you're well-prepared for tax season. Let's dive in!

Read also:Unveiling The Mysteries Of Foz A Comprehensive Guide

Table of Contents

- What is Form 1099-G?

- State Tax Refunds and Form 1099-G

- Who Receives Form 1099-G?

- Important Dates for Form 1099-G

- How to Report State Tax Refunds

- Common Mistakes to Avoid

- Tax Implications of State Refunds

- Filing Options for Form 1099-G

- Tips for Taxpayers Filing Form 1099-G

- Conclusion

What is Form 1099-G?

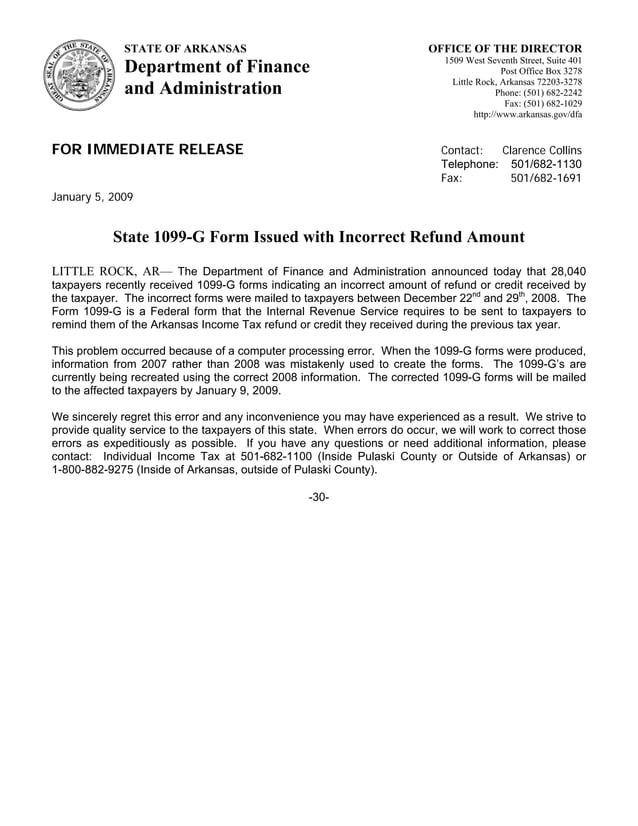

Form 1099-G is an IRS document used to report certain payments made by government entities. These payments may include unemployment compensation, agricultural payments, and, most relevant to our discussion, state tax refunds. The form ensures that taxpayers accurately report any government payments they have received, which could affect their federal tax liability.

Understanding the structure of Form 1099-G is critical. It contains specific boxes that categorize different types of payments, making it easier for taxpayers to identify the nature of the funds received. For instance, Box 1 of the form is dedicated to state tax refunds, credits, or offsets.

Why is Form 1099-G Important?

Form 1099-G serves as a verification tool for the IRS to ensure taxpayers accurately report their income. If you received a state tax refund in the previous year, this form will help you determine whether that refund needs to be included in your gross income for federal tax purposes.

Additionally, Form 1099-G provides transparency in financial transactions between government entities and individuals. It ensures that taxpayers are aware of all payments they've received and helps prevent discrepancies during audits.

State Tax Refunds and Form 1099-G

When you file your state tax return, you may receive a refund if you overpaid your taxes. This refund is reported on Form 1099-G, which is sent to both the taxpayer and the IRS. The form details the amount of the refund and its impact on your federal tax return.

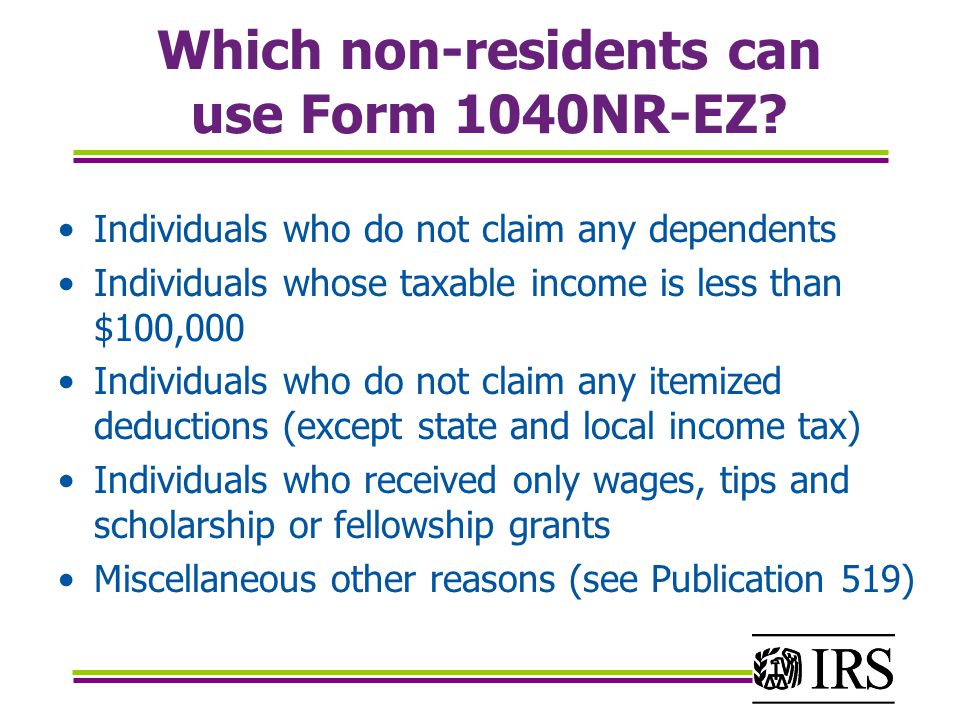

It's essential to note that not all state tax refunds are taxable at the federal level. The taxability depends on whether you itemized deductions in the previous year. If you did, the refund may need to be reported as income in the current year.

Read also:Chase Customer Service Number Your Ultimate Guide To Seamless Banking Solutions

How State Tax Refunds Affect Federal Taxes

State tax refunds can influence your federal tax obligation. If you claimed a deduction for state taxes in a prior year and later received a refund, the IRS may require you to include part of the refund in your gross income. This adjustment ensures that you are not claiming a double deduction.

Who Receives Form 1099-G?

Form 1099-G is issued to individuals who have received specific types of government payments. This includes taxpayers who received state tax refunds, unemployment compensation, or other government-related payments. The form is typically mailed by January 31st of each year.

It's important to verify whether you should expect a Form 1099-G. If you believe you should have received one but haven't, contact the issuing agency promptly to request a copy.

Steps to Verify Your Form 1099-G

- Check your records for any government payments received in the previous year.

- Ensure the amount reported on Form 1099-G matches your records.

- Contact the issuing agency if discrepancies are found.

Important Dates for Form 1099-G

Government agencies are required to issue Form 1099-G by January 31st each year. Taxpayers should receive their forms around this time to allow sufficient time for preparation of federal tax returns. Missing this deadline can lead to penalties for the issuing agency.

As a taxpayer, it's crucial to have all your forms in hand before filing your federal return. If you haven't received your Form 1099-G by mid-February, follow up with the issuing agency to avoid delays in filing.

What Happens if You Don't Receive Form 1099-G?

If you don't receive your Form 1099-G by the expected date, don't panic. You can still file your tax return by estimating the amount of your state tax refund based on your records. However, it's advisable to request a copy from the issuing agency to ensure accuracy.

How to Report State Tax Refunds

Reporting state tax refunds on your federal tax return involves a few steps. First, determine if the refund is taxable. If you itemized deductions in the previous year and received a refund, part of that refund may need to be reported as income.

Use IRS Form 1040 to report your state tax refund. Enter the amount from Box 1 of Form 1099-G on the appropriate line of your federal return. This ensures that the refund is properly accounted for in your tax calculations.

Steps to Report State Tax Refunds

- Locate the amount reported in Box 1 of Form 1099-G.

- Review your previous year's tax return to determine if you itemized deductions.

- Include the refund amount in your federal income if applicable.

Common Mistakes to Avoid

Mistakes in reporting state tax refunds can lead to penalties and interest. One common error is failing to report a refund that should have been included in income. Another mistake is incorrectly calculating the taxable portion of the refund.

To avoid these pitfalls, carefully review your Form 1099-G and consult the IRS instructions for Form 1040. If you're unsure about how to handle your state tax refund, consider seeking advice from a tax professional.

Avoiding Errors in Form 1099-G Reporting

- Double-check the amounts reported on Form 1099-G against your records.

- Ensure you understand the tax implications of your state refund.

- Seek professional help if you're uncertain about the process.

Tax Implications of State Refunds

The tax implications of state refunds depend on your filing status and previous deductions. If you itemized deductions in the prior year and received a refund, the refund may increase your taxable income for the current year. Conversely, if you took the standard deduction, your refund is generally not taxable.

Understanding these implications is crucial for accurate tax planning. It allows you to anticipate any potential increases in your tax liability and prepare accordingly.

Strategies for Managing State Tax Refunds

Consider strategies to manage the impact of state tax refunds on your federal taxes. For example, adjusting your withholding or estimated tax payments can help mitigate any unexpected tax liabilities. Additionally, maintaining accurate records of your deductions and refunds simplifies the filing process.

Filing Options for Form 1099-G

Taxpayers have several options for filing Form 1099-G information with their federal tax returns. You can file electronically using tax preparation software or manually by submitting a paper return. Electronic filing offers speed and accuracy, while manual filing provides more control over the process.

Choose the filing method that best suits your needs and comfort level. Regardless of the method, ensure all information from Form 1099-G is accurately transferred to your federal return.

Benefits of Electronic Filing

- Reduces the risk of errors through automated calculations.

- Speeds up the processing time for your tax return.

- Provides electronic confirmation of submission.

Tips for Taxpayers Filing Form 1099-G

Here are some practical tips to help you navigate the process of filing Form 1099-G:

- Keep detailed records of all government payments and refunds.

- Review your previous year's tax return to determine the impact of your refund.

- Consult IRS resources or a tax professional for clarification on complex issues.

By following these tips, you can ensure a smoother filing experience and minimize the risk of errors.

Staying Organized During Tax Season

Staying organized is key to successful tax filing. Create a system for tracking important documents, including Form 1099-G, W-2s, and other financial records. This organization will save you time and reduce stress during tax season.

Conclusion

In conclusion, understanding the role of Form 1099-G in reporting state tax refunds is vital for accurate federal tax filing. By following the guidelines outlined in this article, you can ensure compliance with IRS regulations and avoid potential penalties.

We encourage you to take action by reviewing your Form 1099-G and preparing your federal tax return with confidence. Share this article with others who may benefit from the information, and explore additional resources on our site for more tax-related insights.

Remember, accurate and timely filing is the key to a stress-free tax season. Stay informed, stay organized, and don't hesitate to seek professional advice when needed.