In today's evolving gig economy, understanding the intricacies of 1099 G BO 2 has become crucial for both freelancers and small business owners. Whether you're receiving a 1099-G form or managing your finances as an independent contractor, it's essential to grasp the implications of this document. This guide will provide you with a thorough understanding of what 1099 G BO 2 entails, its significance, and how to navigate it effectively.

As more individuals embrace freelance work, the tax implications associated with it have gained prominence. The 1099-G form is a critical component of this landscape, particularly when it involves unemployment compensation, state or local income tax refunds, or other government payments. Understanding its nuances can help you avoid costly mistakes during tax season.

This article aims to demystify the complexities surrounding 1099 G BO 2 by providing actionable insights and expert advice. By the end of this guide, you'll be equipped with the knowledge needed to manage your finances confidently and ensure compliance with tax regulations.

Read also:Manuel Garciarulfo Age A Comprehensive Look Into The Life And Career Of The Talented Actor

Table of Contents

Understanding 1099 G BO 2: What It Really Is

The Significance of BO 2 in 1099 G Context

How to Handle 1099 G BO 2 for Tax Purposes

Common Misconceptions About 1099 G BO 2

Impact on Freelancers and Independent Contractors

Read also:Madelyn Cline Naked A Comprehensive And Respectful Exploration

Navigating State and Federal Tax Implications

Strategies for Managing 1099 G BO 2 Payments

Tips for Staying Compliant with IRS Regulations

Conclusion: Taking Control of Your Financial Future

Understanding 1099 G BO 2: What It Really Is

The term "1099 G BO 2" refers to a specific variation of the IRS Form 1099-G. This form is used to report certain types of income from government payments, including unemployment compensation and state or local tax refunds. The "BO 2" component typically denotes specific categories or subcategories of payments, which may vary depending on the issuing authority.

For many taxpayers, receiving a 1099-G form can be confusing, especially if they are unfamiliar with its purpose. Understanding the basics of this form is essential for ensuring accurate tax reporting and avoiding potential penalties.

According to the IRS, the 1099-G form is designed to help taxpayers reconcile their income with government-issued payments. It serves as a record of any payments made by government entities that could impact taxable income.

Why Is the 1099 G Form Important?

The importance of the 1099 G BO 2 form lies in its role as a reporting mechanism for various types of government payments. For instance:

- Unemployment compensation payments

- State or local tax refunds

- Specific grants or subsidies

Each of these payments must be accurately reported to ensure compliance with tax laws. Failing to do so can result in penalties or audits, making it crucial to understand the form's purpose and requirements.

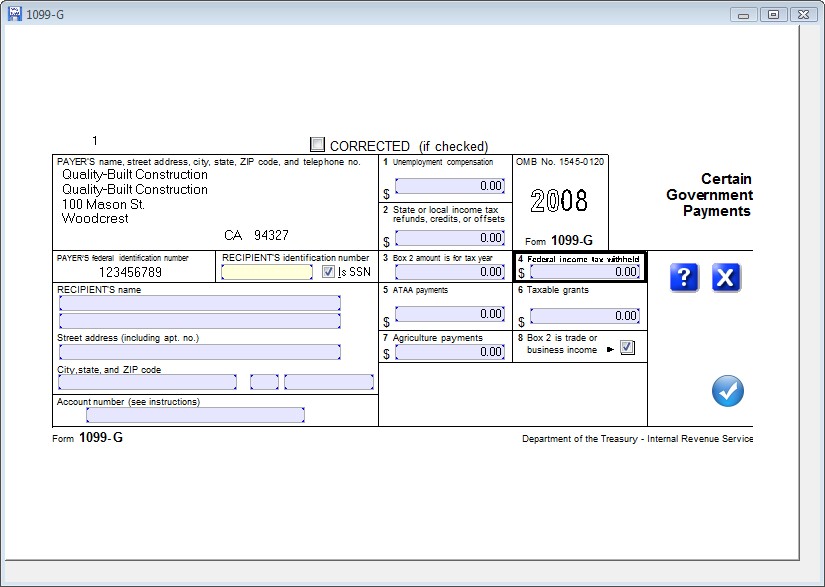

Key Components of Form 1099 G

Form 1099-G contains several key sections that provide detailed information about government payments received during the tax year. These sections include:

- Box 1: State or local income tax refunds

- Box 3: Unemployment compensation

- Box 4: Other specified payments

For taxpayers receiving a 1099 G BO 2 form, the "BO 2" designation may appear in Box 4, indicating a specific type of payment. It's important to review each box carefully to ensure all relevant information is accounted for.

Data from the IRS shows that approximately 40 million 1099-G forms are issued annually, underscoring the widespread use of this document in tax reporting.

How to Interpret the Form

Interpreting the 1099 G BO 2 form requires a clear understanding of its various components. Here are some tips:

- Verify the accuracy of all reported amounts

- Compare the information with your own records

- Consult a tax professional if discrepancies arise

By taking these steps, you can ensure that your tax return accurately reflects all government payments received.

The Significance of BO 2 in 1099 G Context

The "BO 2" designation within the 1099-G form represents a specific category of government payments. While the exact meaning of "BO 2" may vary depending on the issuing entity, it typically refers to unemployment compensation or similar benefits.

According to the U.S. Department of Labor, unemployment compensation is a critical safety net for workers who lose their jobs through no fault of their own. The inclusion of this information on the 1099-G form ensures that recipients accurately report this income for tax purposes.

For taxpayers, understanding the significance of "BO 2" is essential for avoiding common pitfalls. Misinterpreting this designation can lead to errors in tax reporting, resulting in penalties or audits.

Examples of BO 2 Payments

Some common examples of payments categorized under "BO 2" include:

- Unemployment benefits received during the tax year

- Pandemic-related emergency payments

- State-specific unemployment programs

These payments are typically taxable and must be reported on your federal tax return.

How to Handle 1099 G BO 2 for Tax Purposes

Handling a 1099 G BO 2 form requires careful attention to detail. Here are some steps to follow:

- Review the form for accuracy

- Compare the reported amounts with your own records

- Include the relevant information on your tax return

By following these steps, you can ensure that your tax reporting is accurate and compliant with IRS regulations.

According to TurboTax, one of the most common mistakes taxpayers make is failing to report all income sources, including those listed on the 1099-G form. Taking the time to review and understand this form can help you avoid such errors.

Common Errors to Avoid

Some common errors associated with 1099 G BO 2 forms include:

- Overlooking reported amounts

- Miscalculating taxable income

- Forgetting to include the form with your tax return

Avoiding these mistakes can save you time and money during tax season.

Common Misconceptions About 1099 G BO 2

There are several misconceptions surrounding the 1099 G BO 2 form. One common belief is that all payments reported on the form are taxable. However, this isn't always the case. Certain payments, such as state or local tax refunds, may only be taxable if they resulted in a tax benefit in the previous year.

Another misconception is that the 1099-G form is only relevant for freelancers or independent contractors. In reality, it applies to anyone who receives government payments, including unemployment compensation or tax refunds.

Clarifying these misconceptions is essential for accurate tax reporting and compliance.

Debunking Myths

Here are some myths about the 1099 G BO 2 form:

- Myth: All payments reported on the form are taxable

- Reality: Some payments may be partially or fully non-taxable

- Myth: The form is only for freelancers

- Reality: It applies to anyone receiving government payments

Understanding the truth behind these myths can help you make informed decisions about your taxes.

Impact on Freelancers and Independent Contractors

For freelancers and independent contractors, the 1099 G BO 2 form can have significant implications. These individuals often receive multiple forms throughout the year, making it crucial to organize and track all relevant documents.

According to a report by the Freelancers Union, approximately 59 million Americans engage in freelance work, highlighting the growing importance of understanding tax obligations for this demographic.

Managing 1099 G BO 2 forms effectively can help freelancers ensure accurate tax reporting and avoid potential penalties.

Best Practices for Freelancers

Here are some best practices for freelancers dealing with 1099 G BO 2 forms:

- Maintain detailed records of all income sources

- Consult a tax professional for complex situations

- Utilize tax software to streamline the process

Implementing these practices can simplify the tax filing process for freelancers.

Navigating State and Federal Tax Implications

Understanding the tax implications of 1099 G BO 2 forms at both the state and federal levels is crucial for ensuring compliance. While federal tax rules provide a framework for reporting, state-specific regulations may introduce additional complexities.

For example, some states require taxpayers to report state tax refunds on their federal returns only if they itemized deductions in the previous year. Familiarizing yourself with these rules can help you avoid costly mistakes.

Data from the National Conference of State Legislatures highlights the diversity of state tax laws, emphasizing the importance of staying informed about local regulations.

Key Considerations

When navigating state and federal tax implications, consider the following:

- State-specific reporting requirements

- Potential credits or deductions

- Interaction between state and federal taxes

By addressing these considerations, you can ensure comprehensive tax compliance.

Strategies for Managing 1099 G BO 2 Payments

Effectively managing 1099 G BO 2 payments requires a strategic approach. Here are some strategies to consider:

- Organize all relevant documents in one place

- Utilize tax software to simplify the process

- Consult a tax professional for personalized advice

Implementing these strategies can help you stay organized and compliant throughout the tax year.

According to H&R Block, using tax software can reduce errors by up to 90%, making it a valuable tool for managing 1099 G BO 2 forms.

Technology Solutions

Technology offers several solutions for managing 1099 G BO 2 payments:

- Cloud-based accounting software

- Mobile apps for tracking expenses

- Automated tax filing platforms

Leveraging these tools can streamline the tax preparation process and enhance accuracy.

Tips for Staying Compliant with IRS Regulations

Staying compliant with IRS regulations is essential for avoiding penalties and ensuring accurate tax reporting. Here are some tips to help you stay compliant:

- Keep detailed records of all income sources

- Review all forms for accuracy before filing

- Stay informed about changes in tax laws

By following these tips, you can maintain compliance and avoid potential issues.

Data from the IRS shows that maintaining accurate records can reduce the likelihood of audits by up to 50%, underscoring the importance of meticulous documentation.

Conclusion: Taking Control of Your Financial Future

In conclusion, understanding the intricacies of 1099 G BO 2 is crucial for anyone navigating the complexities of modern tax reporting. By familiarizing yourself with the form's components, staying informed about relevant regulations, and implementing best practices, you can ensure accurate and compliant tax reporting.

We encourage you to take action by reviewing your records, consulting a tax professional if needed, and utilizing available resources to simplify the process. Share this article with others who may benefit from