Millions of Americans receive a 1099-G form each year, yet many remain confused about its purpose and implications. The 1099-G form is an essential document issued by state and local governments to report certain payments made to individuals during the tax year. Whether you’ve received unemployment benefits, tax refunds, or other government-related payments, understanding the 1099-G form is crucial for accurate tax filing.

This guide will walk you through everything you need to know about the 1099-G form, including its purpose, how it affects your taxes, and what steps you should take to ensure compliance with IRS regulations. By the end of this article, you'll have a clear understanding of how to handle this form during tax season.

Whether you're a freelancer, a small business owner, or someone who has received government payments, this article will provide actionable insights to help you navigate the complexities of the 1099-G form. Let's dive in.

Read also:Madelyn Cline Nude Debunking Myths And Understanding Privacy In The Digital Age

Table of Contents:

- Introduction to 1099-G

- Background of the Form

- Types of Payments Reported on 1099-G

- When You Should Receive a 1099-G

- How to File Your 1099-G

- Common Mistakes to Avoid

- Impact on Your Taxes

- Unemployment Benefits and 1099-G

- Federal Tax Considerations

- Conclusion

Introduction to 1099-G

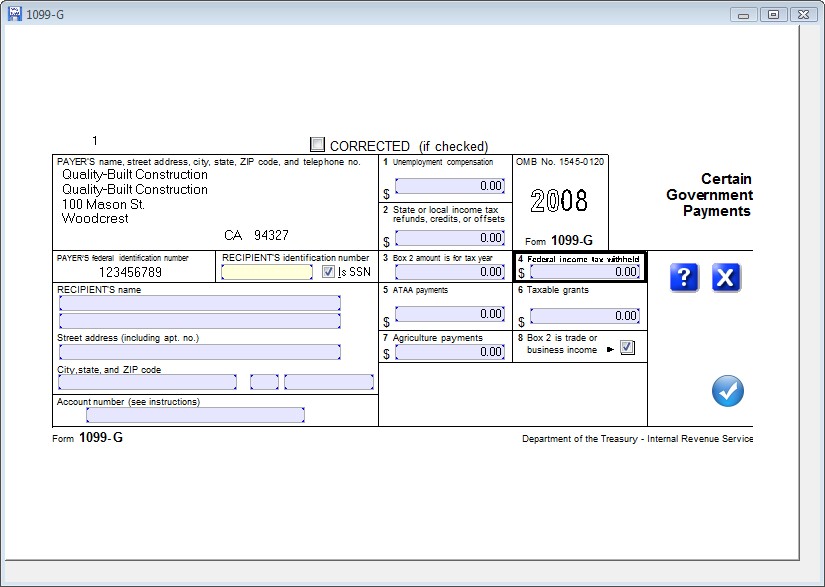

The 1099-G form is a tax document issued by state and local governments to report certain payments made to individuals during the tax year. These payments can include unemployment benefits, state tax refunds, and other government-related disbursements. Understanding the 1099-G is essential for anyone who has received such payments, as it directly impacts your tax obligations.

For example, if you received unemployment benefits during the year, the amount will be reported on the 1099-G form. This information must be included in your federal tax return to ensure accurate reporting and compliance with IRS regulations. Ignoring or misreporting these payments can lead to penalties and interest charges.

Let’s explore the various aspects of the 1099-G form in more detail, starting with its background and history.

Background of the Form

The 1099-G form was introduced by the IRS to streamline the reporting process for government payments. Before its introduction, taxpayers often faced challenges in accurately reporting such payments, leading to errors and potential legal issues. The form provides a standardized method for reporting these payments, ensuring consistency and transparency in the tax system.

Read also:What Is The Council Of Foreign Relations Understanding The Worlds Premier Think Tank

History and Evolution

Over the years, the 1099-G form has evolved to include more types of payments and to adapt to changes in tax laws. Initially, it was primarily used to report state tax refunds, but its scope has expanded to include unemployment benefits, government grants, and other forms of income.

Here’s a brief timeline of the form's evolution:

- 1980s: Introduced to report state tax refunds.

- 2000s: Expanded to include unemployment benefits.

- 2020s: Further updates to accommodate new types of government payments.

Types of Payments Reported on 1099-G

The 1099-G form is used to report a variety of government payments. Below are the most common types of payments you might encounter:

- Unemployment Compensation: Payments received from state unemployment programs.

- State Tax Refunds: Any refunds you received from state income tax filings.

- Government Grants: Payments received from federal or state grants.

- Other Government Payments: This can include disaster relief payments, agricultural subsidies, and more.

Each type of payment is reported in a specific box on the 1099-G form, making it easier for taxpayers to identify and report the correct amounts.

When You Should Receive a 1099-G

By law, state and local governments must issue the 1099-G form to eligible recipients by January 31st of the following year. If you received any of the payments mentioned above, you should expect to receive a 1099-G form around this time. However, delays can occur due to administrative issues or changes in reporting requirements.

What to Do If You Don’t Receive Your Form

If you believe you should have received a 1099-G form but haven’t, it’s important to take action. Contact the issuing agency to request a copy. You can also use IRS Form 4852 (Substitute for Form W-2 or 1099) to report the missing information on your tax return.

How to File Your 1099-G

Filing your 1099-G form correctly is crucial for avoiding tax penalties. Here’s a step-by-step guide to help you through the process:

- Gather Your Documents: Collect all your 1099-G forms and other relevant tax documents.

- Review the Information: Double-check the amounts reported on the form to ensure accuracy.

- Include in Your Tax Return: Report the payments on the appropriate lines of your federal tax return (Form 1040).

- Consult a Tax Professional: If you’re unsure about any aspect of the filing process, consider seeking advice from a certified tax professional.

By following these steps, you can ensure that your tax return is accurate and compliant with IRS regulations.

Common Mistakes to Avoid

When dealing with the 1099-G form, it’s easy to make mistakes that can lead to tax penalties. Here are some common errors to watch out for:

- Forgetting to Report Payments: All payments reported on the 1099-G form must be included in your tax return.

- Miscalculating Taxable Amounts: Some payments, like state tax refunds, may not be fully taxable. Be sure to calculate the correct amounts.

- Ignoring Corrections: If you receive a corrected 1099-G form, update your tax return accordingly.

Avoiding these mistakes will help you maintain compliance and avoid unnecessary complications during tax season.

Impact on Your Taxes

The payments reported on the 1099-G form can significantly impact your tax liability. For example, unemployment benefits are generally considered taxable income, which means you’ll need to pay federal taxes on these amounts. Similarly, state tax refunds may be taxable if they exceed the deduction you claimed on your previous year’s return.

How to Minimize Your Tax Burden

There are several strategies you can use to reduce the tax impact of 1099-G payments:

- Withhold Taxes from Benefits: Opt for voluntary tax withholding on unemployment benefits to avoid a large tax bill at the end of the year.

- Consult Tax Deductions: Explore available deductions and credits that may offset your taxable income.

- Plan Ahead: Regularly review your tax situation to anticipate and manage potential liabilities.

Unemployment Benefits and 1099-G

Unemployment benefits are one of the most common types of payments reported on the 1099-G form. These benefits are generally considered taxable income, so it’s important to report them accurately on your tax return. In 2021, the American Rescue Plan provided some relief by excluding the first $10,200 of unemployment benefits from federal taxes for individuals earning less than $150,000.

Recent Changes in Unemployment Tax Laws

Stay updated on the latest changes in unemployment tax laws, as they can affect how much you owe. For example, some states offer additional tax breaks or exclusions for unemployment benefits. Always consult the IRS website or a tax professional for the most current information.

Federal Tax Considerations

When filing your federal taxes, the information on your 1099-G form must align with your reported income. The IRS uses this information to verify the accuracy of your tax return. If discrepancies are found, you may receive a notice or face penalties.

Tips for Federal Tax Compliance

- Verify All Information: Cross-check the amounts on your 1099-G form with your personal records.

- Stay Organized: Keep all tax-related documents in one place for easy access during filing season.

- Use Tax Software: Consider using reputable tax software to streamline the filing process and reduce errors.

Conclusion

Understanding the 1099-G form is essential for anyone who has received government payments during the tax year. Whether it’s unemployment benefits, state tax refunds, or other forms of income, accurately reporting these payments on your tax return is crucial for compliance with IRS regulations.

By following the steps outlined in this guide, you can ensure that your tax filing process is smooth and error-free. Remember to review all information carefully, consult a tax professional if needed, and stay informed about any changes in tax laws that may affect your situation.

We encourage you to share this article with others who may benefit from it and leave a comment below if you have any questions or feedback. For more insights on tax-related topics, explore our other articles on the site.