Millions of Americans receive a 1099-G form each year, but many are left wondering what it is and why it matters. A 1099-G is an essential tax document issued by state or local governments to individuals who received certain types of income during the tax year. Understanding this form is crucial for accurate tax filing and avoiding potential penalties.

The 1099-G form is not just a piece of paper; it plays a significant role in the tax process. Whether you’ve received unemployment benefits, government refunds, or other payments from state or local authorities, this form ensures that all your income is accurately reported to the IRS. Ignoring or misunderstanding it could lead to costly mistakes during tax season.

In this article, we’ll break down everything you need to know about the 1099-G, including its purpose, how to interpret it, and why it’s vital for your tax return. By the end, you’ll have a clear understanding of how to handle this document and ensure compliance with tax regulations.

Read also:Understanding 1099g Colorado A Comprehensive Guide To Tax Forms And Filing

Table of Contents

- What is a 1099-G?

- Types of Income Reported on 1099-G

- Who Receives a 1099-G?

- How to Read Your 1099-G Form

- The Importance of the 1099-G in Tax Filing

- Common Mistakes to Avoid with 1099-G

- Unemployment Benefits and the 1099-G

- Taxable vs. Nontaxable Income on 1099-G

- IRS Guidelines for 1099-G Filers

- Conclusion: Take Control of Your Taxes

What is a 1099-G?

A 1099-G is a tax form used to report certain types of government payments received by individuals during the tax year. It’s issued by state and local governments to taxpayers who have received unemployment compensation, government refunds, or other specified payments. The IRS uses this information to ensure that all income is properly accounted for in your tax return.

The form provides details about the payments you received, making it easier for you to report them accurately on your federal tax return. If you’ve received a 1099-G, it’s important to review it carefully and understand the information provided to avoid discrepancies when filing your taxes.

Types of Income Reported on 1099-G

The 1099-G form covers a variety of income sources, including:

- Unemployment compensation

- State or local tax refunds

- Credit or offset amounts

- Other specified payments from government entities

Each type of income is reported in specific boxes on the form, allowing you to categorize and report them correctly on your tax return.

Unemployment Compensation

Unemployment benefits are one of the most common forms of income reported on the 1099-G. These payments are typically taxable and must be included in your gross income when filing your taxes. If you’ve received unemployment benefits, the amount will be listed in Box 1 of your 1099-G form.

Who Receives a 1099-G?

Not everyone will receive a 1099-G. This form is sent to individuals who meet certain criteria, such as:

Read also:Manuel Garciarulfo Age A Comprehensive Look Into The Life And Career Of The Talented Actor

- Receiving unemployment benefits during the tax year

- Receiving a state or local tax refund

- Receiving any other specified payments from government entities

If you fall into any of these categories, you should expect to receive a 1099-G by the end of January following the tax year.

How to Read Your 1099-G Form

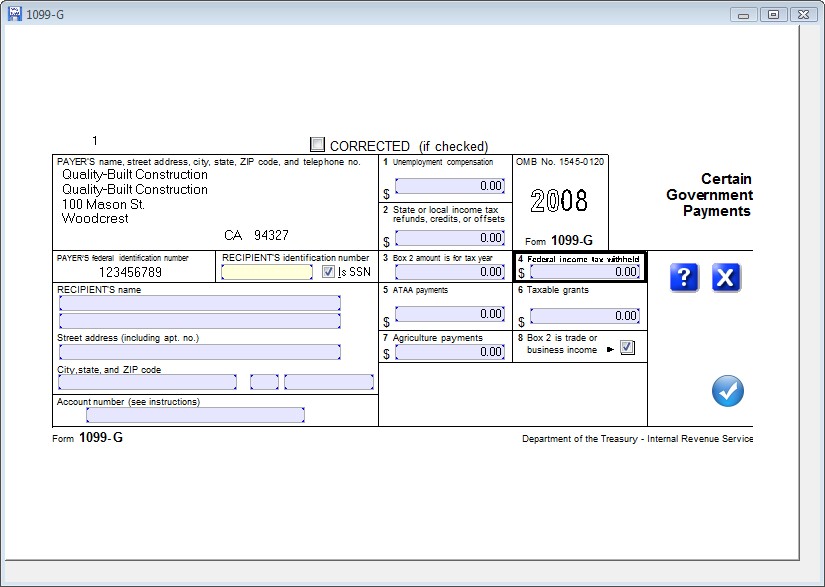

Understanding how to read your 1099-G is essential for accurate tax reporting. The form is divided into several boxes, each representing a different type of income or payment. Here’s a breakdown of the most important boxes:

- Box 1: Total unemployment compensation received

- Box 2: State or local income tax refunds

- Box 3: Credit or offset amounts

- Box 4: Other specified payments

Review each box carefully and compare the amounts listed with your own records to ensure accuracy.

Understanding the Boxes on Your 1099-G

Each box on the 1099-G serves a specific purpose. For example, Box 1 reports unemployment compensation, which is taxable income. Box 2 reports any state or local tax refunds you may have received, which could impact your taxable income depending on your filing status and deductions.

The Importance of the 1099-G in Tax Filing

The 1099-G plays a critical role in the tax filing process. It ensures that all income you’ve received from government sources is accurately reported to the IRS. Failing to report this income could result in penalties, interest, or even an audit. By using the information provided on your 1099-G, you can ensure that your tax return is complete and compliant with federal regulations.

Avoiding Penalties with Accurate Reporting

One of the key reasons to pay attention to your 1099-G is to avoid penalties for underreporting income. The IRS matches the information on your tax return with the data reported on your 1099-G. Any discrepancies could trigger further scrutiny, so it’s important to double-check the amounts and include them in your tax calculations.

Common Mistakes to Avoid with 1099-G

While the 1099-G is a straightforward form, mistakes can still happen. Here are some common pitfalls to avoid:

- Forgetting to include unemployment compensation in your taxable income

- Not reporting state or local tax refunds correctly

- Misinterpreting the information in the boxes

- Ignoring the form altogether

By staying vigilant and reviewing your 1099-G carefully, you can avoid these errors and ensure a smooth tax filing process.

Unemployment Benefits and the 1099-G

With the rise in unemployment claims during economic downturns, many taxpayers are receiving 1099-G forms for unemployment benefits. These payments are generally taxable and must be included in your gross income. It’s important to note that some states may offer tax relief for unemployment benefits, so be sure to check your state’s guidelines.

Tax Relief Options for Unemployment Benefits

Some states provide tax relief for unemployment benefits, especially during periods of high unemployment. For example, the American Rescue Plan Act of 2021 excluded the first $10,200 of unemployment compensation from federal taxes for taxpayers earning less than $150,000. Be sure to consult the IRS website or a tax professional for the latest updates on tax relief options.

Taxable vs. Nontaxable Income on 1099-G

Not all income reported on the 1099-G is taxable. While unemployment compensation and state tax refunds are generally taxable, other payments, such as certain credits or offsets, may not be. It’s important to review the IRS guidelines or consult a tax professional to determine which portions of your 1099-G income are subject to taxation.

IRS Guidelines for Taxable Income

The IRS provides clear guidelines on which types of income reported on the 1099-G are taxable. For example, unemployment compensation is always taxable, while state tax refunds may only be taxable if you itemized deductions in the previous year. Familiarizing yourself with these guidelines can help you avoid overpaying or underpaying your taxes.

IRS Guidelines for 1099-G Filers

The IRS has specific rules and regulations for filers of the 1099-G form. Employers and government entities are required to issue the form by January 31st each year, and taxpayers must include the information on their federal tax returns. Failure to comply with these guidelines can result in penalties for both the issuer and the recipient.

Tips for Compliance with IRS Regulations

To ensure compliance with IRS regulations, follow these tips:

- Review your 1099-G carefully before filing your taxes

- Include all reported income in your tax calculations

- Keep copies of your 1099-G for your records

- Consult a tax professional if you have questions or concerns

Conclusion: Take Control of Your Taxes

In conclusion, understanding what a 1099-G is and how it impacts your tax return is essential for accurate and compliant tax filing. By familiarizing yourself with the types of income reported on the form, how to read it, and the IRS guidelines, you can avoid common mistakes and ensure that all your income is properly accounted for.

We encourage you to take action by reviewing your 1099-G carefully and seeking professional advice if needed. Don’t forget to share this article with others who may benefit from the information, and explore our other resources for more insights into tax planning and compliance.