Understanding the intricacies of tax documents like the 1099-G is crucial for anyone who resides in Colorado or receives income from the state. Whether you've received unemployment benefits, tax refunds, or other government payments, the 1099-G form plays a pivotal role in your tax reporting. In this article, we'll delve into the specifics of the 1099-G Colorado form, its importance, and how it impacts your tax obligations.

As tax season approaches, many individuals in Colorado are often confused about the various forms they receive. One such form is the 1099-G, which reports certain types of income from government entities. This document is essential for accurately filing your federal and state taxes.

By the end of this guide, you'll have a clear understanding of what a 1099-G Colorado is, how to interpret it, and how it fits into your overall tax strategy. Let's begin by exploring the basics.

Read also:Madelyn Cline Naked A Comprehensive And Respectful Exploration

Table of Contents

- Introduction to the 1099-G Colorado

- What is a 1099-G Form?

- Colorado-Specific Details of the 1099-G

- Types of Income Reported on the 1099-G

- Unemployment Benefits and the 1099-G

- Tax Refunds Reported on the 1099-G

- How to File with the 1099-G

- Common Questions About the 1099-G

- Tips to Avoid Common Mistakes

- Conclusion

Introduction to the 1099-G Colorado

The 1099-G Colorado form is a tax document issued by state or local government entities to individuals who have received certain types of income during the tax year. This form provides critical information that taxpayers need to accurately report their earnings on federal and state tax returns.

In Colorado, taxpayers may receive a 1099-G for various reasons, including unemployment compensation, state tax refunds, or other government payments. Understanding the purpose of this form and its implications is essential for ensuring compliance with tax laws.

By familiarizing yourself with the 1099-G, you can better prepare for tax season and avoid potential penalties or audits. Let's explore what the 1099-G form entails in more detail.

What is a 1099-G Form?

The 1099-G form is an IRS document used to report income received from government entities. It is issued to individuals who have received payments such as unemployment benefits, state tax refunds, or other government-related income. The form ensures that taxpayers accurately report this income when filing their taxes.

For Colorado residents, the 1099-G is particularly important because it includes details about payments made by the state government. These payments may include unemployment compensation, tax refunds, or other forms of financial assistance provided by the state.

According to the IRS, failure to report income listed on the 1099-G can result in penalties or interest charges. Therefore, it's crucial to review this form carefully and include the information on your tax return.

Read also:Somnector The Ultimate Guide To Revolutionizing Sleep Technology

Colorado-Specific Details of the 1099-G

Unemployment Benefits in Colorado

In Colorado, unemployment benefits are a common reason for receiving a 1099-G form. The state's Division of Employment and Training issues these forms to individuals who received unemployment compensation during the tax year. This income must be reported on both federal and state tax returns.

According to data from the Colorado Department of Labor and Employment, unemployment benefits increased significantly in recent years due to economic disruptions. As a result, more taxpayers are receiving the 1099-G form and need to understand its implications.

Tax Refunds and Credits

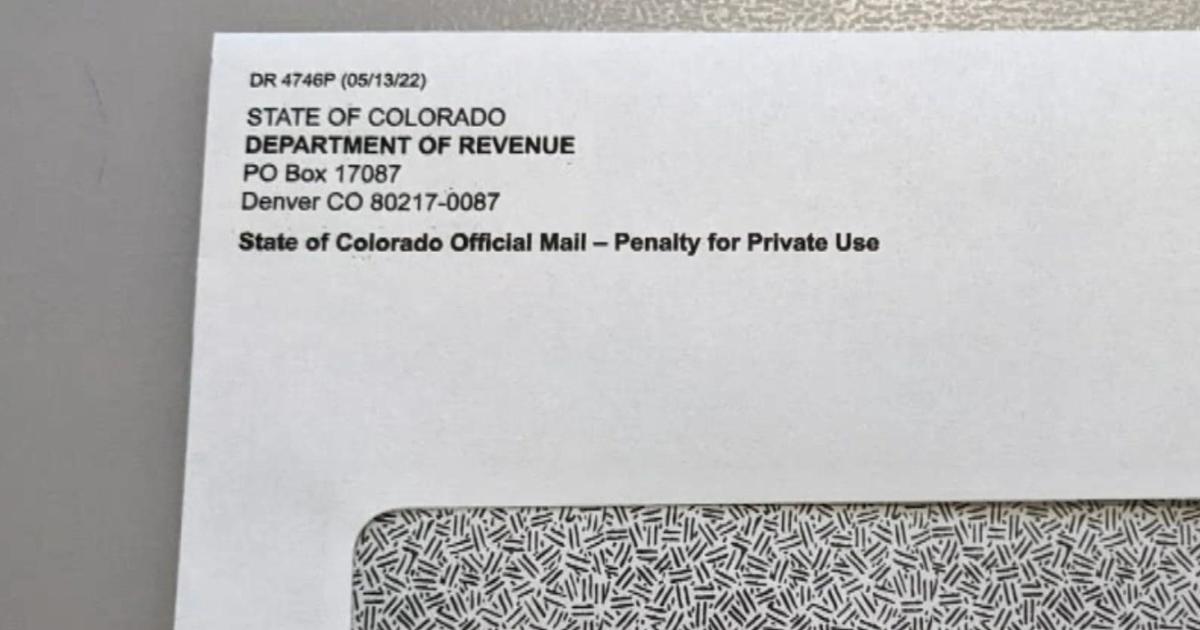

Another common reason for receiving a 1099-G in Colorado is state tax refunds. If you received a refund or credit from the Colorado Department of Revenue, it will be reported on this form. While state tax refunds are generally not taxable at the federal level, they may affect your state tax liability.

For example, if you claimed a deduction for state taxes paid in the previous year, receiving a refund may require you to adjust your federal tax return accordingly.

Types of Income Reported on the 1099-G

The 1099-G form reports various types of income, including:

- Unemployment compensation

- State tax refunds

- Government grants

- Reimbursements or other payments from government entities

In Colorado, the most common types of income reported on the 1099-G are unemployment benefits and state tax refunds. However, depending on your situation, you may also receive this form for other government payments.

It's important to note that not all income reported on the 1099-G is taxable. For example, certain grants or reimbursements may be excluded from your taxable income. Consult the IRS guidelines or a tax professional for clarification.

Unemployment Benefits and the 1099-G

Reporting Unemployment Compensation

If you received unemployment benefits in Colorado, you will likely receive a 1099-G form at the end of the tax year. This form reports the total amount of unemployment compensation you received, which must be included in your taxable income.

According to the IRS, unemployment benefits are considered taxable income and must be reported on your federal tax return. Colorado follows the same guidelines, requiring you to include this income on your state tax return as well.

Withholding Taxes on Unemployment Benefits

When receiving unemployment benefits, you have the option to have federal taxes withheld. This can simplify your tax filing process by ensuring that taxes are paid throughout the year. If you did not elect to have taxes withheld, you may need to make estimated tax payments to avoid penalties.

For Colorado residents, withholding state taxes on unemployment benefits is also an option. Consult the Colorado Department of Labor and Employment for more information on how to set up withholding.

Tax Refunds Reported on the 1099-G

Understanding State Tax Refunds

If you received a tax refund from the Colorado Department of Revenue, it will be reported on the 1099-G form. While state tax refunds are generally not taxable at the federal level, they may impact your federal tax return if you claimed a deduction for state taxes paid in the previous year.

For example, if you itemized deductions and claimed a deduction for state taxes paid in 2022, receiving a refund in 2023 may require you to adjust your federal tax return. The 1099-G form will provide the necessary information to make this adjustment.

State Credits and Rebates

In addition to tax refunds, the 1099-G may also report state credits or rebates you received during the tax year. These payments must be carefully reviewed to determine if they are taxable. Consult the IRS or a tax professional for guidance on how to handle these payments.

For Colorado residents, common state credits and rebates include energy efficiency incentives and property tax credits. Ensure that you understand the tax implications of these payments before filing your return.

How to File with the 1099-G

Steps to File with the 1099-G

Filing your taxes with a 1099-G involves several steps:

- Review the 1099-G form carefully to ensure all information is accurate.

- Include the reported income on your federal and state tax returns.

- Adjust your federal tax return if necessary due to state tax refunds or credits.

- Submit your tax return by the deadline to avoid penalties.

Using tax preparation software or consulting a tax professional can help simplify the process and ensure accuracy.

Common Filing Mistakes

Some common mistakes taxpayers make when filing with a 1099-G include:

- Forgetting to include unemployment compensation as taxable income.

- Not adjusting federal tax returns for state tax refunds.

- Misinterpreting the information reported on the 1099-G.

Avoiding these mistakes can save you time and money during tax season. Double-check all calculations and seek professional advice if needed.

Common Questions About the 1099-G

Do I Need to Report All Income on the 1099-G?

Not all income reported on the 1099-G is taxable. For example, certain grants or reimbursements may be excluded from your taxable income. Review the IRS guidelines or consult a tax professional to determine which income must be reported.

What Happens if I Don't Receive My 1099-G?

If you don't receive your 1099-G by the end of January, contact the issuing government entity to request a copy. You can still file your taxes without the form by estimating the reported income based on your records. However, obtaining an official copy is recommended to ensure accuracy.

Tips to Avoid Common Mistakes

To avoid errors when filing with a 1099-G, follow these tips:

- Double-check all information reported on the form for accuracy.

- Include all taxable income reported on the 1099-G in your tax return.

- Adjust your federal tax return if necessary due to state tax refunds or credits.

- Use tax preparation software or consult a tax professional for assistance.

By taking these precautions, you can ensure a smooth and error-free tax filing process.

Conclusion

In conclusion, understanding the 1099-G Colorado form is essential for anyone who receives income from government entities in the state. Whether you've received unemployment benefits, tax refunds, or other payments, accurately reporting this income is crucial for compliance with tax laws.

We encourage you to review the information provided in this guide and take the necessary steps to prepare for tax season. If you have further questions or need assistance, consider consulting a tax professional or using reputable tax preparation software.

Don't forget to share this article with others who may find it helpful, and explore our other resources for more tax-related insights. Your feedback and engagement are valuable to us!