Understanding the 1099 G State ID Number is crucial for anyone who has received unemployment benefits, government payments, or other taxable income from state agencies. This document plays a significant role in accurately reporting your tax obligations to the IRS. As tax regulations evolve, staying informed about this form and its requirements is essential for maintaining compliance and avoiding potential penalties.

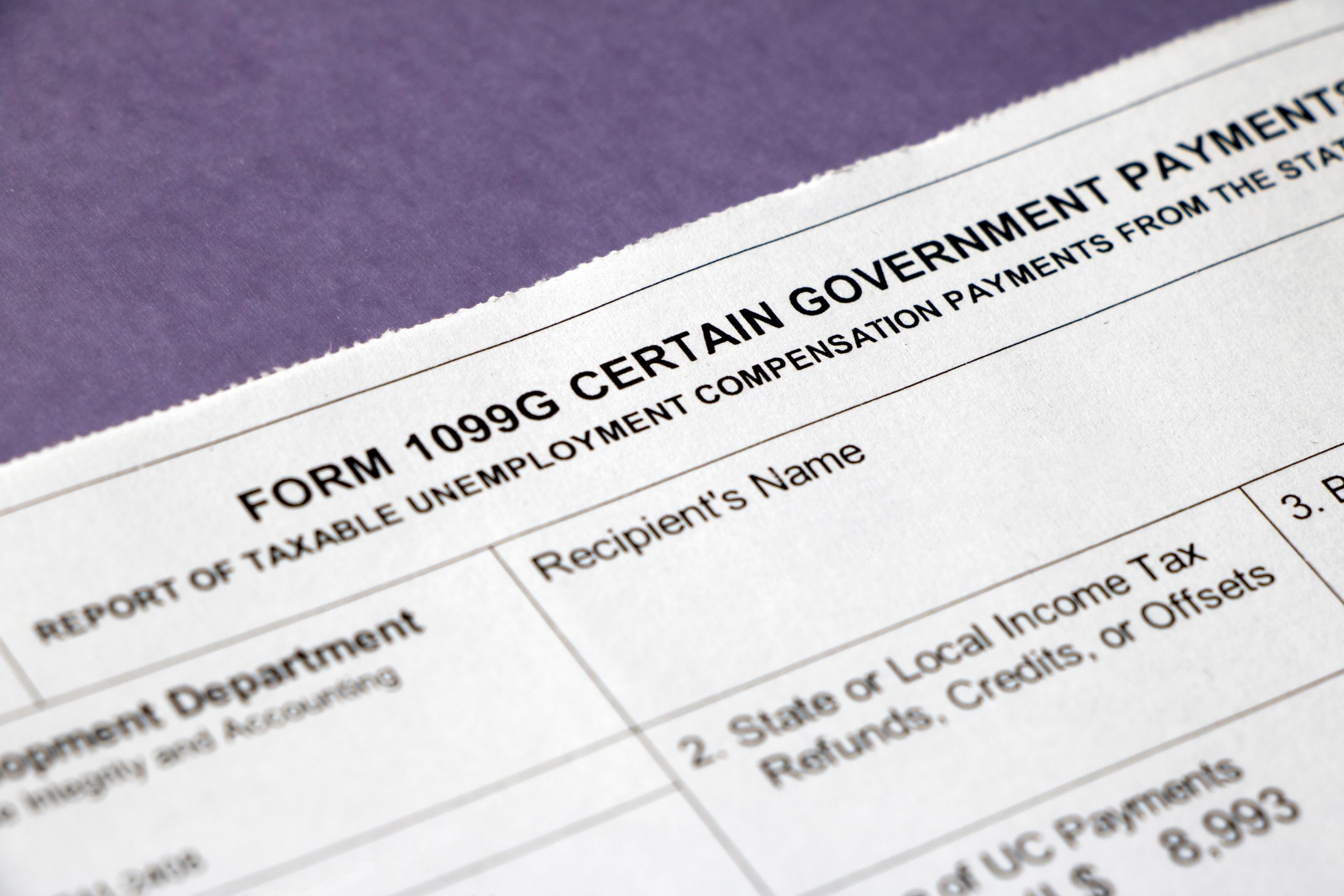

The 1099-G form is an official IRS document that reports certain types of income you may have received during the tax year. These include unemployment compensation, state tax refunds, and other government payments. Whether you're a freelancer, small business owner, or someone who received unemployment benefits, understanding the 1099-G form and its associated state ID number is vital for accurate tax reporting.

In this comprehensive guide, we will delve into the intricacies of the 1099-G State ID Number, providing actionable insights and expert advice to ensure you remain compliant with tax regulations. From understanding the form's purpose to exploring its implications, this article aims to equip you with the knowledge needed to navigate the complexities of tax reporting effectively.

Read also:Tigerconnect Competitors A Comprehensive Analysis Of Key Players In The Market

Table of Contents

- What is 1099-G State ID Number?

- Who Receives the 1099-G Form?

- Key Components of the 1099-G Form

- Understanding the State ID Number

- The Filing Process Explained

- Common Issues and How to Resolve Them

- Tax Implications of 1099-G

- Tips to Avoid Penalties

- Useful Resources and Tools

- Conclusion and Next Steps

What is 1099-G State ID Number?

The 1099-G form is a document issued by government entities to report payments made to individuals during the tax year. These payments may include unemployment compensation, state or local tax refunds, and other government-related income. The State ID Number on the form identifies the issuing agency and ensures accurate reporting to the IRS.

This form is particularly important for taxpayers who received unemployment benefits or any form of government assistance. By understanding the 1099-G State ID Number, you can ensure that your tax return accurately reflects all sources of income, avoiding potential discrepancies or penalties.

Why is the 1099-G Important?

The 1099-G serves as a critical tool for tax compliance. It provides a detailed breakdown of payments received from government entities, enabling taxpayers to report their income correctly. Here are some reasons why the 1099-G is essential:

- Ensures accurate reporting of government payments.

- Helps identify discrepancies between reported and actual income.

- Facilitates compliance with IRS regulations.

Who Receives the 1099-G Form?

The 1099-G form is issued to individuals who have received specific types of income from government entities. These include:

- Unemployment compensation.

- State or local tax refunds.

- Government grants or awards.

- Other taxable payments from state or federal agencies.

It's important to note that not all government payments are reported on the 1099-G. For instance, Social Security benefits are reported on a different form. Understanding whether you qualify for the 1099-G is crucial for accurate tax reporting.

Eligibility Criteria

Eligibility for receiving the 1099-G depends on the type of income you've received. If you've received unemployment benefits or a state tax refund, you are likely to receive this form. Always check with your state's tax agency to confirm eligibility.

Read also:Lincoln Heritage Final Expense Reviews A Comprehensive Analysis

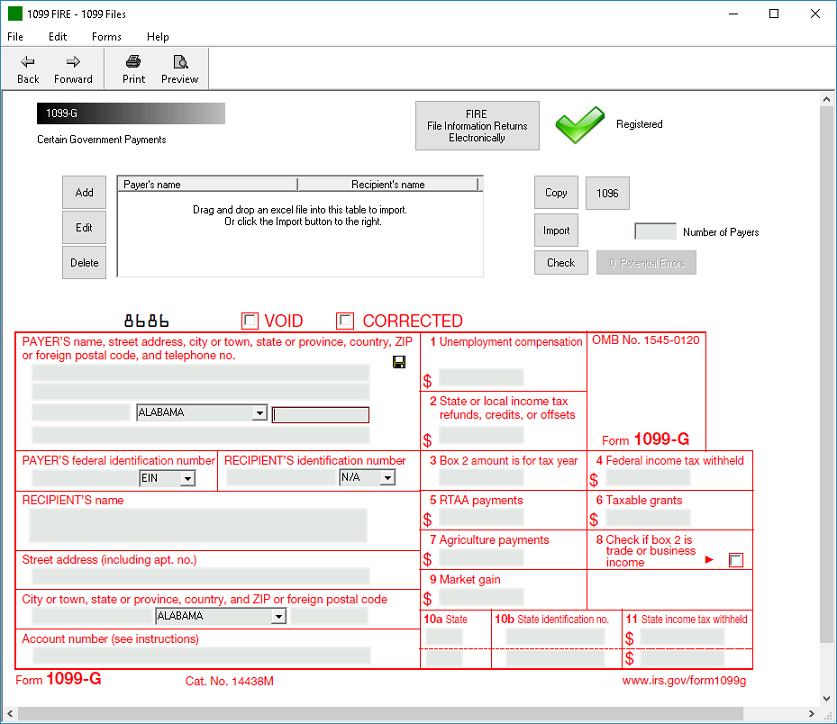

Key Components of the 1099-G Form

The 1099-G form contains several key components that provide detailed information about your income. Understanding these components is essential for accurate tax reporting:

- State ID Number: Identifies the issuing agency.

- Box 1 (Refunds, Credits, or Offset): Reports state or local tax refunds.

- Box 3 (Unemployment Compensation): Reports unemployment benefits received.

- Box 7 (Other Income): Reports other types of government payments.

How to Read the Form

Reading the 1099-G form requires careful attention to detail. Each box provides specific information about the payments you've received. For example, Box 3 will detail any unemployment compensation you've received, while Box 7 may include other forms of income. Always verify the accuracy of the information provided on the form.

Understanding the State ID Number

The State ID Number on the 1099-G form is a unique identifier assigned to the issuing agency. This number ensures that payments are accurately attributed to the correct state or local government entity. Understanding the State ID Number is crucial for verifying the authenticity of the form and ensuring accurate reporting.

How to Verify the State ID Number

To verify the State ID Number on your 1099-G form, you can:

- Contact your state's tax agency for confirmation.

- Check the IRS website for a list of valid State ID Numbers.

- Compare the number with previous years' forms, if applicable.

The Filing Process Explained

Filing your taxes with the 1099-G form involves several steps. Here's a comprehensive guide to the filing process:

Step 1: Gather Necessary Documents

Before you begin filing, ensure you have all necessary documents, including:

- Your 1099-G form.

- Other income statements, such as W-2s or 1099s.

- Previous year's tax return for reference.

Step 2: Report Income Accurately

When reporting income from the 1099-G, ensure that all amounts match the figures on the form. Discrepancies can lead to penalties or audits. Use the State ID Number to verify the issuing agency and ensure accuracy.

Common Issues and How to Resolve Them

While filing with the 1099-G form, you may encounter certain issues. Here are some common problems and solutions:

Issue 1: Discrepancies in Reported Income

If the income reported on your 1099-G does not match your records, contact the issuing agency immediately. They can provide clarification or issue a corrected form if necessary.

Issue 2: Missing Forms

If you haven't received your 1099-G form by the end of January, contact the issuing agency to request a copy. You can also check their website for electronic versions of the form.

Tax Implications of 1099-G

The 1099-G form has significant tax implications. Payments reported on this form are generally taxable and must be included in your gross income. Understanding these implications is crucial for accurate tax reporting:

Unemployment Compensation

Unemployment benefits reported on the 1099-G are taxable. Ensure that you account for these payments when calculating your taxable income.

State Tax Refunds

State tax refunds reported on the 1099-G may be taxable if you itemized deductions in the previous year. Consult a tax professional for guidance on this matter.

Tips to Avoid Penalties

Avoiding penalties associated with the 1099-G form requires careful planning and attention to detail. Here are some tips:

- Verify all information on the form before filing.

- File your taxes by the deadline to avoid late filing penalties.

- Consult a tax professional if you're unsure about any aspect of the form.

Useful Resources and Tools

Several resources and tools can help you navigate the complexities of the 1099-G form:

- IRS Forms and Publications

- IRS Taxpayer Advocate Service

- State-specific tax agency websites

Conclusion and Next Steps

In conclusion, understanding the 1099-G State ID Number is essential for accurate tax reporting. By familiarizing yourself with the form's components, eligibility criteria, and filing process, you can ensure compliance with IRS regulations and avoid potential penalties.

We encourage you to take the following steps:

- Review your 1099-G form carefully before filing.

- Utilize available resources to clarify any doubts or questions.

- Share this article with others who may benefit from the information.

For more insights into tax-related topics, explore our other articles and resources. Your feedback and comments are always welcome!

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)